How ThoughtRiver can help your organization cut costs, the right way.

Inflation is on the rise. But even though it is largely caused by staggering energy prices, systemic inflation driven by the labor market is also likely – unless we are very careful.

Those of us who are old enough may recall that we have been here before. For instance, there were similar economic issues in 2008 and 1990. However, what’s different in 2022 is that we are faced with a very tight labor market, especially in the legal sector.

So how can organizations protect themselves from high recruitment/salary costs and increasing law firm fees?

The answer is legal tech. In this article, we’ll discuss how inflation is changing the dynamic of supply chain relationships and outline the ways ThoughtRiver can act as an anti-inflationary measure.

How is inflation affecting supplier relationships?

In July 2022, global not-for-profit association World Commerce & Contracting released a survey report analyzing views from over 450 responses and interviews regarding the impact of inflation on business relationships – with a particular focus on long-term services agreements.

Based on the findings, it is clear that even though organizations are not taking any panic measures, they’re taking the potential impact of inflation seriously.

In fact, buyers and suppliers are taking many steps to protect themselves, and sometimes even each other, from this latest disruption.

According to the report:

- When asked to rate the extent to which they feel inflationary pressures are resulting in increased tensions between buyers and their suppliers, (on a scale of one to 10 where 10 is a major increase), buyers gave an average rating of 7.4. Suppliers gave a slightly higher rating of 8.2.

- Buyers and suppliers both believe that “strength of relationship” has the greatest influence on their behavior.

- Both parties feel that the pandemic and subsequent events have improved levels of collaboration. This can be seen in their readiness to engage in discussions on how best to manage inflationary pressures (e.g. cost reduction or margin protection measures).

- A majority of both buyers and suppliers are reviewing contract terms related to price changes. In many cases, they’re seeking to insert new (but contradictory) provisions. It’s therefore inevitable that these factors will increase levels of negotiation.

- Given current pressures, we can also expect contract types to change. Buyers and suppliers agree there may be sizable upgrades in performance, outcome, and agile contracts. However, there is less of a consensus on the types of charging models that will be used, again suggesting increased tension in negotiations.

- The pandemic and subsequent market disruptions are majorly affecting many procurement organizations. This means their role and purpose are currently being reassessed.

- There is less evidence of similar appraisals in sell-side commercial teams. However, the interviews do suggest an increased urgency in technology deployment and skills uplift.

Inflation’s effect on negotiations and contract types

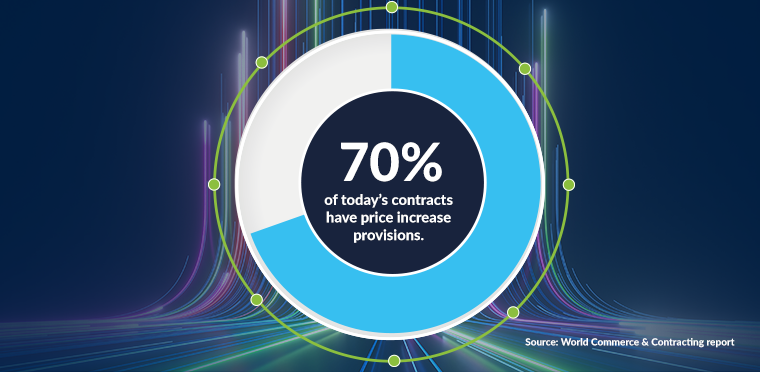

WCC’s report indicates that 70% of today’s contracts have price increase provisions. The most common provision is the use of indices, followed by general annual price reviews.

However, because of inflation, 67% of buyers and 76% of suppliers are also adding or revising clauses relating to price changes in their future contracts.

Not only are buyers reconsidering which indices to use more seriously, but they are also requesting greater transparency from suppliers on cost make-up – and potentially, margins as well. We can also see their push for an “open book” approach in their demands to ensure price or charge reductions when inflationary pressures and input costs are reduced in the future.

Suppliers, on the other hand, are inserting new or updated pricing provisions (often index-linked) and more frequent rights of review.

Overall, the general belief is that contract types and charging models will change. And as the rate of inflation continues to rise in many countries, it is apparent that this period of financial and business uncertainty is likely to persist.

How ThoughtRiver helps

While technology may not be able to change the economic landscape, it can assist in its management. Here’s how.

1. It enables smarter, more efficient negotiations by giving reviewers the tools to optimize and manage the contract review

ThoughtRiver’s AI is trained to ask the same questions of every contract as your lawyers would. It democratizes an initial contract review by letting smart technology do the hard work. In essence, anyone can process the contract review as ThoughtRiver will provide the same, high-quality, consistent output – no matter who uploads the contract. In this way it’s easier, and more cost-effective, to manage negotiations.

2. It allows you to focus on negotiations, not language

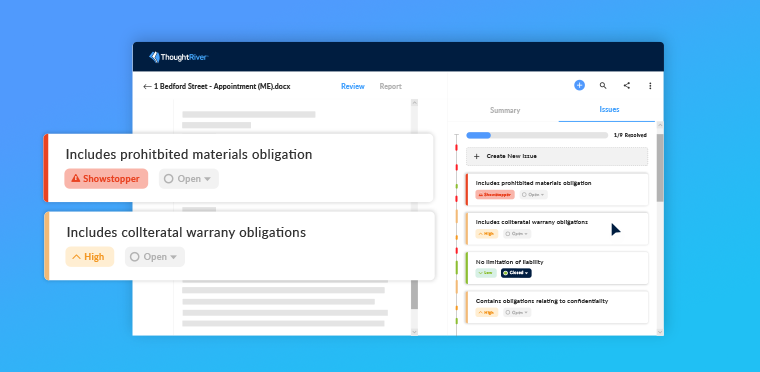

ThoughtRiver uses AI to review your contract and create a digital Issues List that documents any terms that are likely to block getting to signature. This Issues List can be shared internally with colleagues and stakeholders so they see where you’re at with negotiations, but more importantly with your counterparty so they can quickly understand your positions.

This means you can start negotiating on a much smaller list of snags rather than the whole document, allowing you to focus on what really matters (and not redlining legalese that does not add any value to negotiations).

3. It greatly reduces the time to signature

Deal velocity is critical because the longer it takes to get to a signature, the more ‘deal leakage’ there is. And the quicker you get to signature, the more likely you are to win the deal and gain the full value of the contract.

By enabling you to start negotiations on a smaller Issues List, ThoughtRiver helps you laser in on removing deal blockers and speeding time to signature. Not only is it more efficient, but you also get more value from negotiations (so you can spend less on legal fees).

4. You get powerful contract analytics

ThoughtRiver also gives you a powerful contract analytics capability to help your legal or commercial team answer questions from the business. Questions where the answers are usually hidden deep within the companies signed contracts. Questions like “which of our customer contracts contain a price indexation clause that allows us to raise prices?”, or “what protections do our contracts offer against price increases?”.

While these questions may seem simple and straightforward, when you need to search across thousands of contracts it becomes impossible for many organizations to effectively answer them in a reasonable timeframe.

That is where an AI-powered platform can review tens of thousands of contracts for such a clause in a fraction of the time (minutes per contract), and with even greater accuracy.

For example, you can use ThoughtRiver to find all your customer contracts that contain language allowing them to raise prices. Or ThoughtRiver can allow you to quickly search for risk in their supplier agreements. Regardless of the question you want to ask, our AI can be quickly trained to answer it.

Come take a look at ThoughtRiver today

When there is inflation, organizations rightfully feel the need to reduce business expenses. As the report reveals, many are taking steps to protect themselves from rising costs. But in order to curb the crisis effectively, it’s important to ensure that the right types of costs are cut.

ThoughtRiver’s inflation-busting AI software speeds up all contract processes, enabling you to save time and money by relying less on recruiting new legal staff or hiring legal firms to do what can be done in a fraction of the time.